Summer Snippets

10 guides to help you level-up your user research skills this summer

Hello! I haven’t published any newsletters here on The Full-Stack Researcher for almost 4 months because I wasn’t sure if what I’ve been writing would be interesting enough to justify sending an email to all 17,000+ of you…

Sooooo instead of the usual deep-dive guide, today’s newsletter features a list of nine snippets from recent blog posts about user research that I wrote but never shared publicly on here (along with one excellent guest post I wish I had written!).

I am already prepping my next deep-dive guide which I aim to publish in mid-August, so worry not, The Full-Stack Researcher will return to its typical format very soon :)

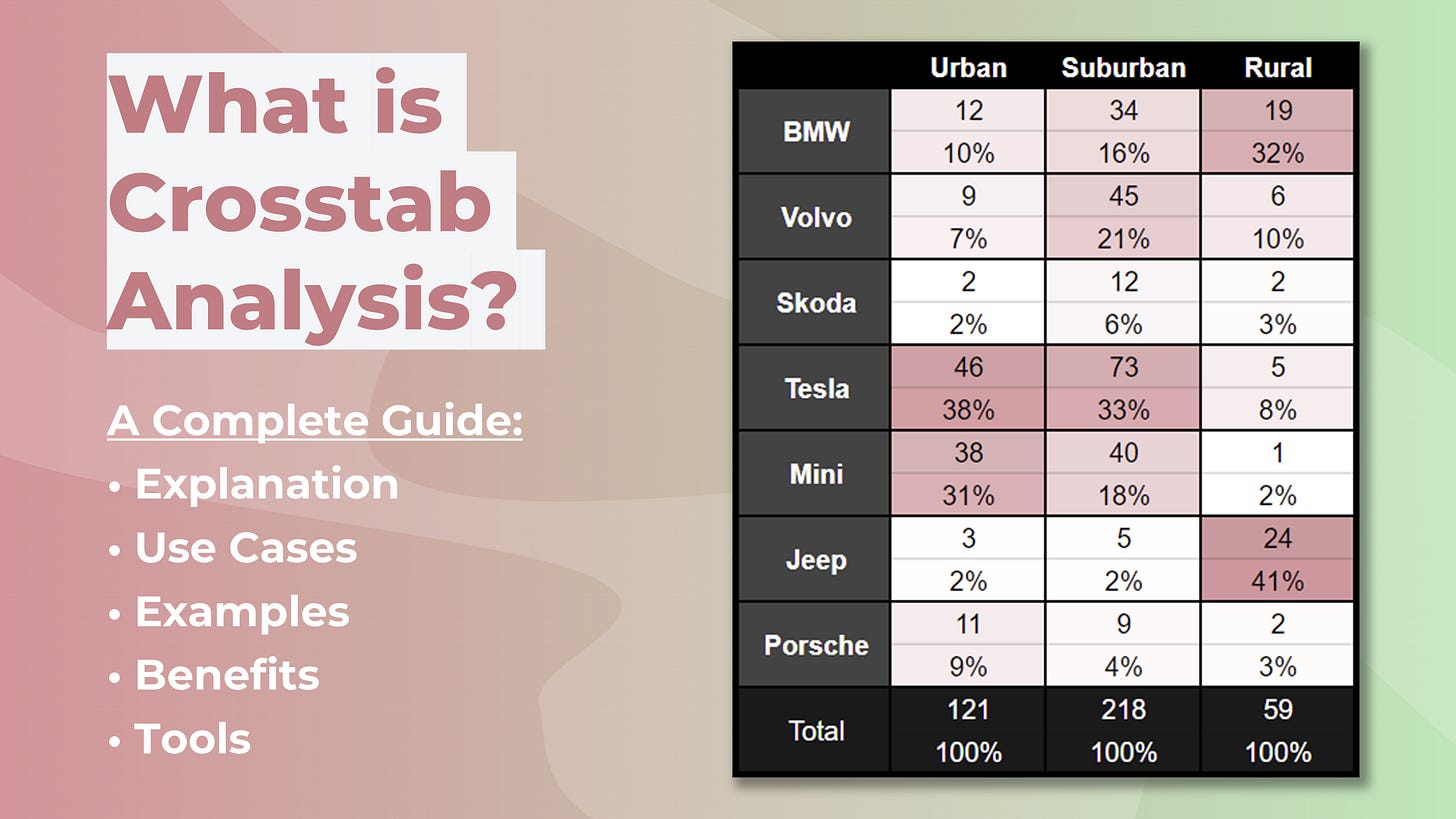

1. What Is Crosstab Analysis?

Crosstabulation analysis is one of those research terms that sounds way scarier than it actually is. It involves putting two questions across from each other on a table (hence the name “cross-tab”) to see how much they overlap in your survey results/dataset. Crosstabs are a great way to check how balanced your participant pool is, look for outliers in how different groups think about a topic, and compare segments of customers against each other in a visual way. This guide covers everything you need to know about crosstab analysis, from explanations and real examples to a review of the 9 most popular research tools that offer crosstabulation.

2. The Bestseller That Almost Wasn’t

“My new book, Growth Levers and How to Find Them, ranks in the top 0.03% of all titles on Amazon, but it almost never got published. Here’s the story of a philosopher, a poet, and a bestseller that almost wasn’t.” — Matt Lerner

One of the best blog posts I’ve read recently, this story by Matt Lerner (founder of SYSTM and a former director at PayPal) is a short and memorable explanation of the editorial processes that turned his 500-page rambling book into a 112-page bestseller. It covers broadly-applicable advice about turning your ideas into stories that sell — many of us would benefit from considering Matt’s experience more often in our day-to-day work.

3. How to Measure Your Company’s Culture

Over the past few months, I’ve helped a handful of companies conduct internal surveys measuring company culture using the OCAI framework and use segmentation analysis to compare differences between types of employees (like by department, seniority, location, etc). This guide covers how the OCAI assessment works, includes a one-click copy of the survey template, and explains some suggestions that will help ensure the success of your future company culture assessment.

4. What is Psychographic Customer Segmentation?

When attempting customer segmentation research, most people either end up with useless fictional personas created by sales/marketing teams without any real underlying data or extremely technical clustering analyses produced by teams of PhD data scientists showing which button clicks correlate with higher customer retention. Neither of these are particularly useful for user researchers! This guide to psychographic segmentation bridges that gap with a more reasonable middle ground — giving you a straightforward methodology for measuring psychographics (ie. how people think/feel) and layering in descriptive data so that you can identify which types of people think/feel similarly.

5. The Ultimate Guide to Conjoint Analysis

I previously shared a post here on Substack called “The Most Misunderstood Research Method In All The Land” that explained some of the most common misconceptions people tend to have about Conjoint Analysis. It got quite the reaction — so much so that I’ve since ended up helping a bunch of teams with conjoint studies. I decided to put everything I know about this research method together to create the most comprehensive guide to conjoint analysis on the entire internet. This >8000-word guide really embodies the “deep” part of “deep dive” (along with a handy contents section so that you can jump to whatever section is relevant to you).

6. What is Pairwise Comparison? [Video]

Researchers should always be skeptical of stated preference research. Asking people what they care about is surprisingly unreliable and difficult to do effectively, even for experienced researchers. Instead, when looking to validate insights generated through qualitative research, you should instead choose a method that uses revealed preference testing — ie. something that creates realistic decisions and tracks the choices that participants make to figure out what they actually care about most. Researchers are absolutely sleeping on pairwise comparison, which is one of the most flexible, easy-to-use, and broadly unknown survey formats for revealed preference research.

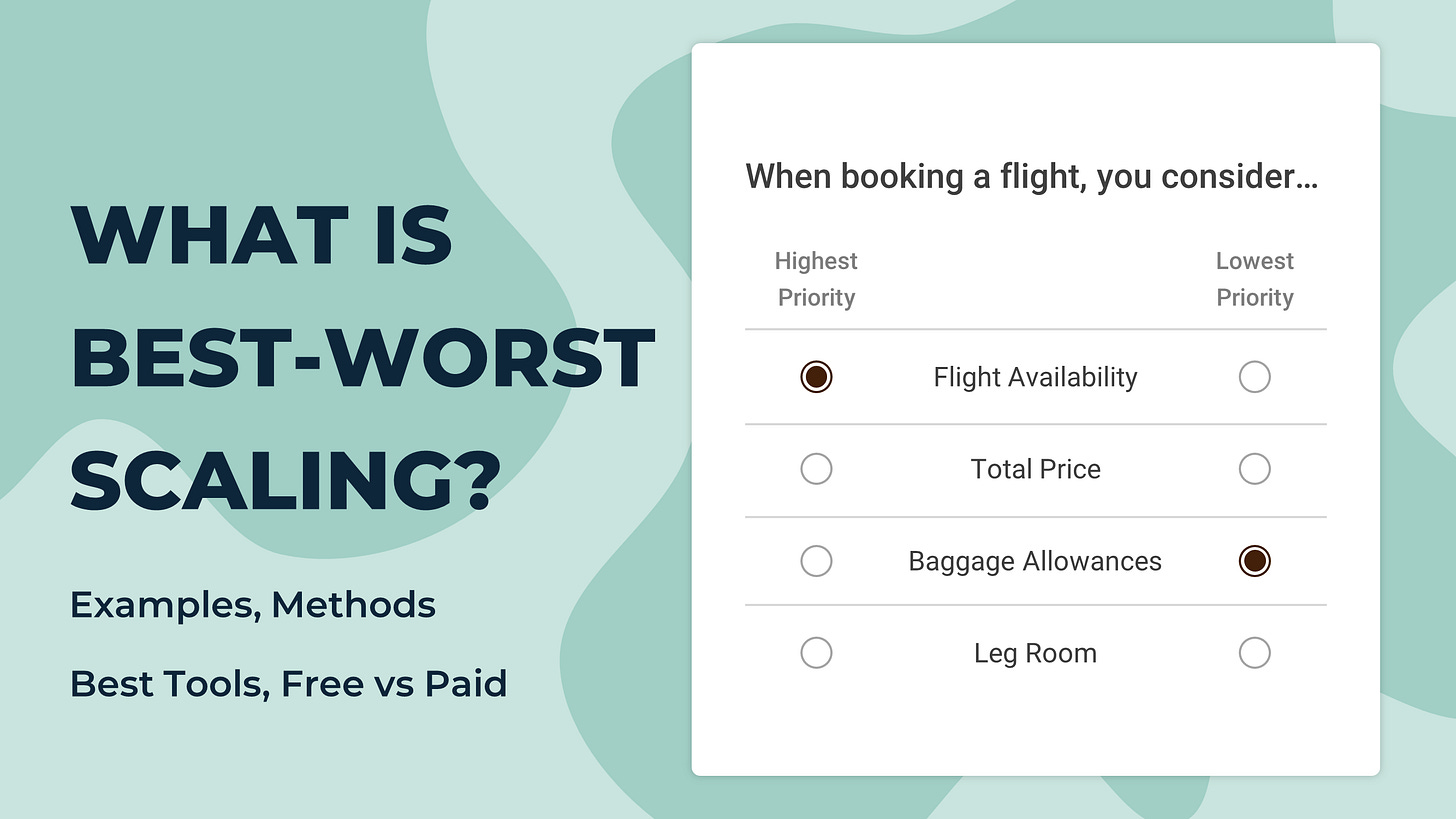

7. What is Best-Worst Scaling?

Also known as MaxDiff Analysis, Best-Worst Scaling is often considered an “advanced” research method — this is not true and the only people who repeat it ad nauseam online are the survey companies that are trying to charge you an arm and a leg to unlock their "Advanced Tier” maxdiff question formats. This guide explains Best-Worst Scaling in more detail, with interactive examples, a review of the most popular survey tools (including free options), and explanations that will reassure you that MaxDiff analysis is a lot more straightforward than you’ve been led to believe.

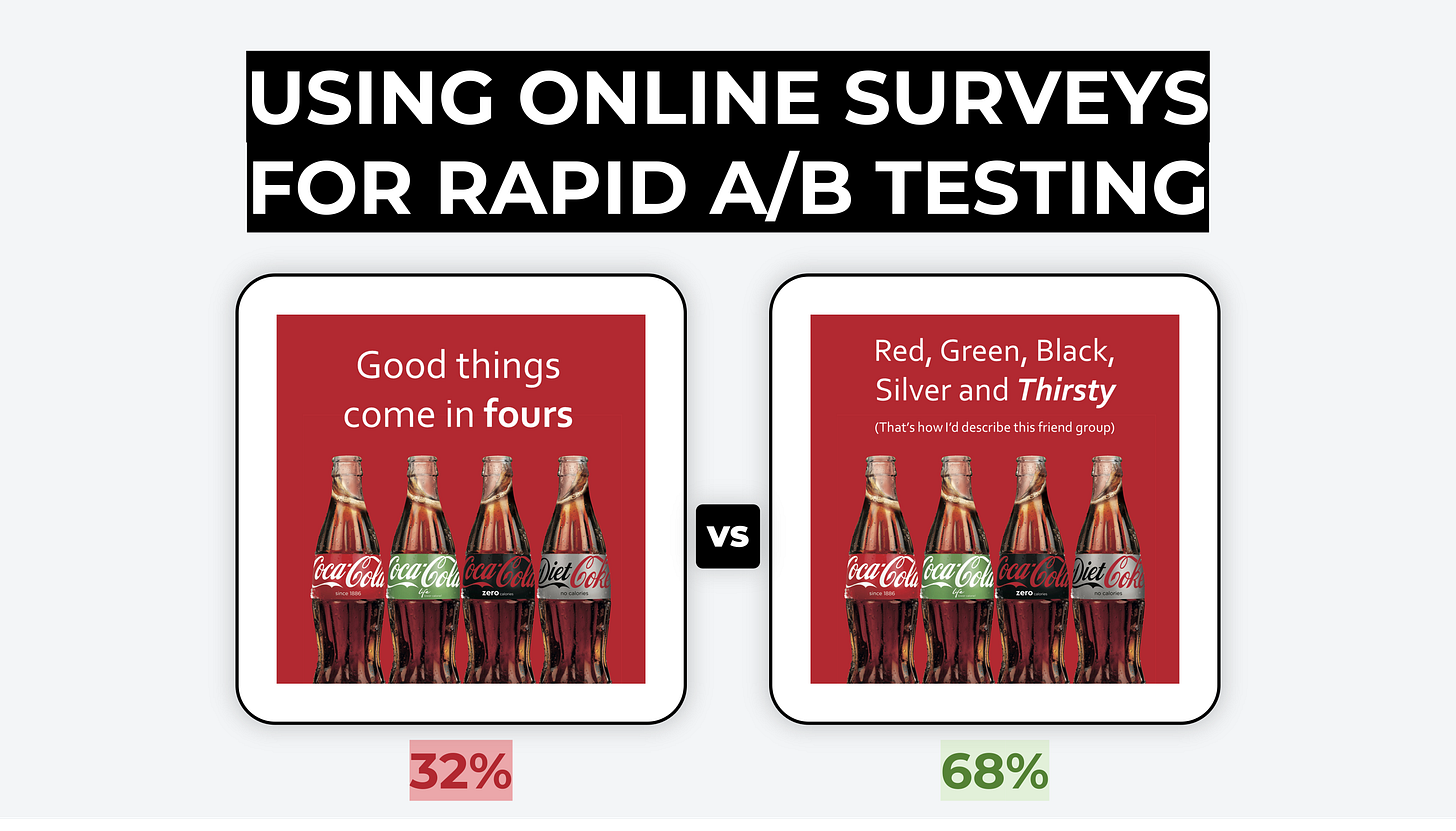

8. Using Surveys to A/B Test Concept Images

Preference testing and A/B surveys are popular ways for designers to identify which concept images resonate most with target users. This guide covers some important things to consider when designing an A/B concept test survey, from research methods to analysis considerations.

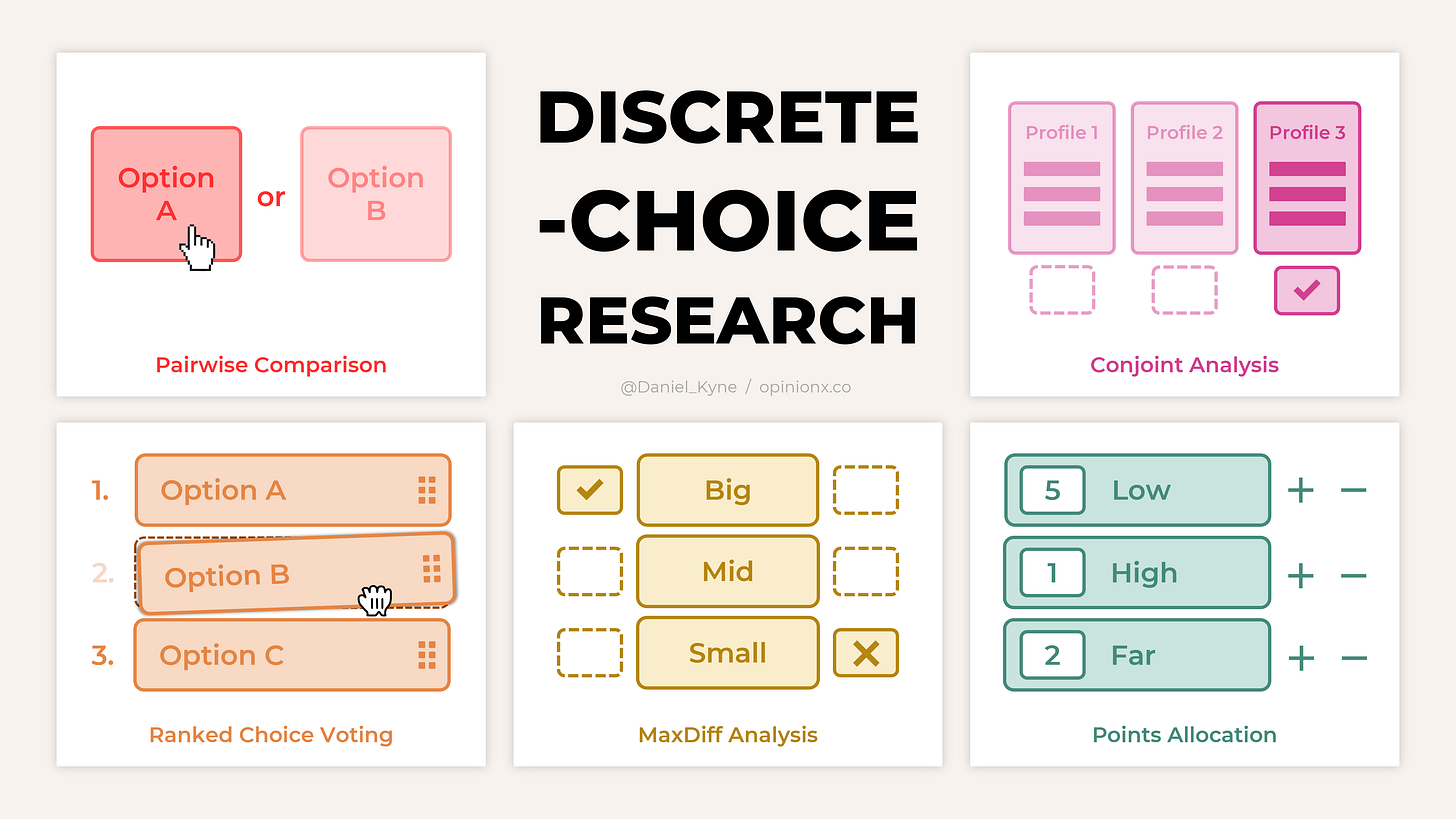

9. What is Discrete-Choice Modeling?

Many people incorrectly say that “discrete-choice modeling” and conjoint analysis are the same thing. As the name suggests, “discrete choice” means giving people separate options and using their answers to “model” what their preferences are. Conjoint analysis is a good multi-variable approach to discrete-choice modeling, but it is not the only approach that falls into this category of research methods. This guide dispels this inaccuracy by diving deeper into the various methods of discrete-choice analysis you can use to create tests that surface people’s revealed preferences through simple choice-based tasks.

10. Product/Market Fit Survey Templates (19 Examples)

Back in February, I published “Product/Market Fit Surveys for Data Science Rookies”, which explained how the PMF Survey was not well-known until people realized that they only really deliver value when you segment your results to compare your engaged customers vs disinterested users. While writing that newsletter edition, I realized that a LOT of the product/market fit survey templates you can find online were very clearly written by people who have never done user research before. I gathered up 19 examples and created my own templates — one for beginners, one that’s more advanced, and an expert-level template too — to help you conduct better segmentation-focused PMF surveys.

Read more →

— — —

Thanks for taking the time to read this edition of The Full-Stack Researcher! Enjoy your summer and I look forward to sharing my next deep-dive guide with you in August 🌞

~ Daniel