Deconstructing WeatherBill's $930M Startup Pivot

The recipe used by the most successful startups to build billion dollar growth machines.

In 2013, David Friedberg sold his 7-year-old startup WeatherBill for $930M.

But for its first 3 years — despite an A-list line-up of investors and early hires — WeatherBill floundered. If it wasn’t for one finely-tuned pivot in May 2010, the company was destined for certain failure.

This essay deconstructs David’s $930M pivot using a simple framework to show how many of the world’s most successful startups use the same recipe to build growth machines worth 9+ figures.

A Trillion Dollar Idea

Back in 2006, David Friedberg used to drive past a rental store called The Bike Hut each morning on the way to work in San Francisco. Whenever it rained, The Bike Hut would be closed for the day.

David thought this was kinda crazy — the amount of money The Bike Hut could make was dependent on how many days it rained each month. But the more he thought about it, the more common this kind of business situation seemed to be.

A company’s revenue is so often dependent on the weather. After some research, David realized that almost 70% of all businesses are affected by weather — the equivalent of $3.8 trillion of US GDP at the time. It seemed obvious to him that these companies should have automated weather insurance. So David quit his job at Google and set out to build exactly that. He called his startup ‘WeatherBill’.

David had been part of the early team behind AdWords at Google. And as it turned out, the core technology for AdWords was the exact same as what you’d need for a digital insurance platform — make sense of a mountain of data and then determine a custom fee to charge each customer for the value extracted.

This seems like a dream startup recipe. David had relevant industry experience, an existing network in Silicon Valley to raise from, and a trillion-dollar addressable market to capture. Selling weather insurance seemed like the perfect golden egg.

Having raised $16.8M in funding in 2006/07, David bought a bunch of weather data and launched the first version of WeatherBill in January 2007. But for the following 3 years, WeatherBill struggled to build compounding traction…

Selling Everything To Everyone All At Once

In that first year of business, the WeatherBill team cold-called companies from every weather-impacted industry they could think of and asked “why aren’t you buying our stuff?”

“The idea was to put the website up and the 70% of businesses with weather problems would show up saying ‘Finally, I always wanted this! I’m so glad you made this, let me just take my credit card out to buy this...’. But nobody bought it.” — David Friedberg, October 2011

David’s sales team would phone construction companies and say “doesn’t it cause delayed in your operations when it rains?”. They’d call farmers and ask “if there’s a freeze, you’re gonna lose your entire crop, right?”. They worked their way down a long list that included outdoor events, travel, construction, energy, municipality government, agriculture, and more.

They realized through this process that weather insurance was something that people wanted, but for each call they needed to stop and say, “okay, so tell me how the weather affects you specifically?” Based on the answer, the salesperson wouldn’t just have to tailor the WeatherBill story — they’d even have to use the product on that lead’s behalf to get a price for them. Everything had to be done for the customer.

They learned a little about all 10 industries they were targeting, but never went deep enough to build the perfect solution for any one segment of customers.

David lost almost three years on this scattergun approach.

In late 2009, with a bank balance racing towards zero, David still had no successful sales process that could be scaled for any market. They couldn’t grow the business.

So in a desperate final attempt, David sat his team down and said “Let’s make a bet…”

Specificity-Induced Discovery

The team decided to pick one customer segment and burn the rest of their runway focusing only on selling to them. After taking a look at all their list of target industries, they decided to bet on farmers.

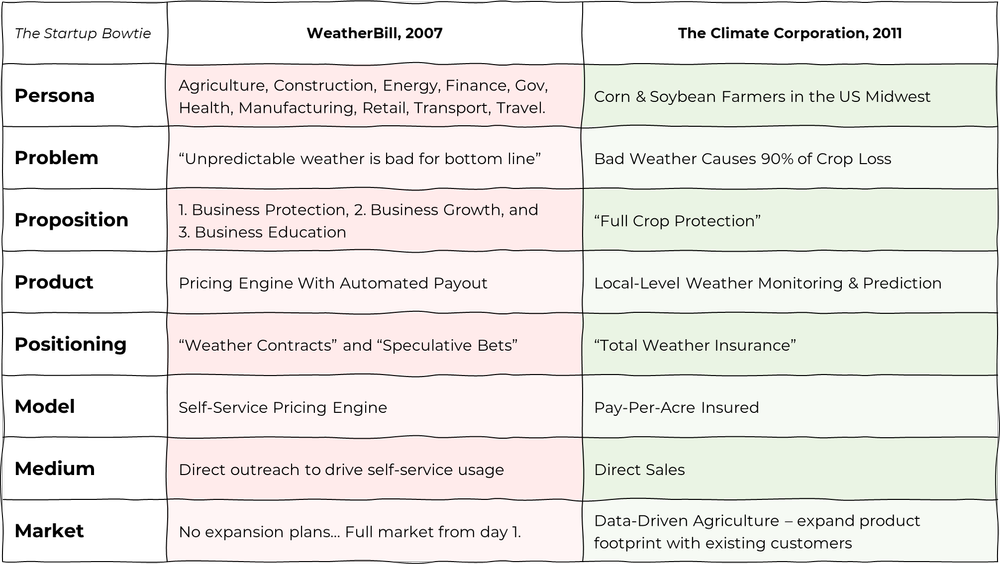

So as they rolled into 2010, David’s team began to rebuild WeatherBill just for farmers. And immediately, they could see why farmers had not been buying beforehand. Here’s what happened to each ingredient in their startup mix once WeatherBill began to pivot to farmers:

Persona

Right on WeatherBill’s doorstep was one of the most intensive agricultural areas in the world. In 2011, there were 160 million acres of corn and soy planted in the Midwest US, producing over 33% of the world's supply of each of those crops. Corn and soybean farmers shared a common set of demographics and weather-related problems, meaning they could be repeatedly targeted without needing to tailor the sales message each time.

Problem

Once they started talking only to corn and soybean farmers, David realized that the crop agriculture sector was hit harder by weather events than any other industry on his list. Bad weather accounts for 90% of crop losses around the world.

Proposition

WeatherBill launched on TechCrunch in January 2007 with the headline “Use WeatherBill To Bet On The Weather”. Their convoluted value proposition centered on making “speculative bets on the weather” and WeatherBill was technically a regulated financial instrument. This made no sense to farmers. Once the other customer segments had been eliminated, it was clear that the value farmers wanted was simply “Full Crop Protection”.

Product

WeatherBill’s prediction system had initially been based on 400 weather stations around the US. But farmers don’t care about rainfall 150 miles away, they care about rainfall at their exact location. So David’s team built a new prediction system with 14,000 grids that would provide much more accurate local weather data.

Positioning

According to David, farmers wouldn’t buy WeatherBill “unless it was written on insurance paper”. So WeatherBill applied for full regulatory approval across all 51 US regions. In 2010 they became a licensed insurer and began offering “Total Weather Insurance”.

With their pivot in full flow, David’s team used these farmer-specific discoveries to design a repeatable outbound sales model specifically for corn and soybean farmers in the US Midwest. By October 2011, WeatherBill was converting over 50% of farmers that their sales teams pitched.

WeatherBill cemented its pivot by rebranding to The Climate Corporation in November 2011, before being acquired by Monsanto for $930M in October 2013.

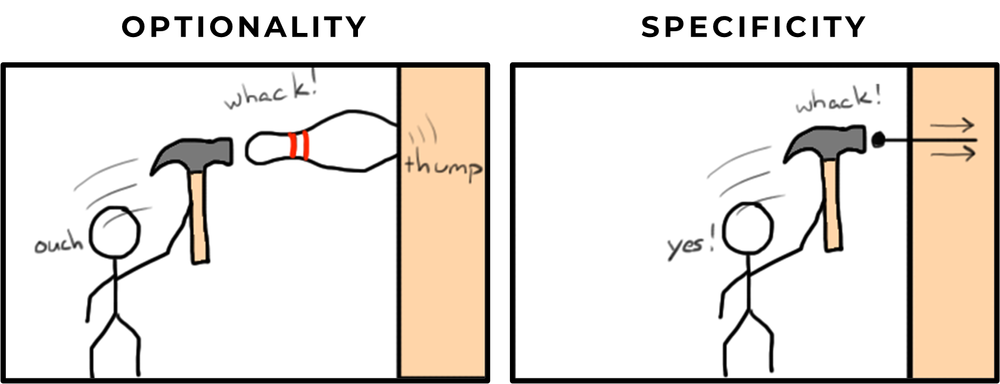

Optionality Tax

The easy lesson to take from WeatherBill’s 7-year story is that hedging your bets on multiple customer segments is not the key to a large market opportunity. Instead, optionality is a barrier to growth.

“Before we can serve everyone, we have to serve someone.” — Rob Fitzpatrick, author of The Mom Test

David’s initial research showed a $3.8T market that shared a common pain point. If he had taken a similar top-down market sizing approach in 2007 for only farmers, he would’ve found that it was $112B. That’s a 97% reduction. There’s no way David would have imagined back in 2007 that cutting his addressable market by 97% would be the difference between failure and a $930M exit. That’s the pitfall of top-down market sizing (mistake #1), and hedging your bets on multiple target customer segments (mistake #2).

It was only after David committed to a single customer segment that he realized:

What looks from a top-down perspective to be a smaller market often serves as the entry point into a huge and much more tangible opportunity when quantified from a bottom-up perspective (Learning #1)

Often times your underlying technology becomes the foundation for building a suite of product tools for that initial customer segment, resulting in an even bigger prize that you could never have quantified upfront (Learning #2).

This was exactly what happened in the case of WeatherBill.

Learning #1: David didn’t need pursued municipal governments, ski resorts, construction companies or music festival organizers. In the end, he realized that targeting farmers alone was a huge prize that no company was better set to take than WeatherBill:

“There’s 160 million acres of corn and soybeans planted just in the Midwest of the United States. Our product costs $40 an acre. There’s $6 billion revenue we’re going after and … more than half of the farmers that are offered our product actually buy it.” — David Friedberg, 2011

Learning #2: WeatherBill had become one of the world’s largest providers of weather data by 2013. They leveraged this credibility as a trusted source of industry data to create a suite of tools for data-driven agriculture:

“The company’s proprietary Climate Technology Platform™ combines hyper-local weather monitoring, agronomic modeling, and high-resolution weather simulations to deliver a suite of tools that helps farmers manage risk [and] … improve profitability by making better informed operating decisions.” — Atomico, 2013

What We Can Learn From WeatherBill’s Pivot

WeatherBill’s pivot was so successful because David understood (1) the dependencies that exist between the different ingredients that go into a successful startup mix and (2) the order in which decisions must be made.

By focusing on crop farmers, David was finally able to clearly articulate exactly what problem is created by bad weather for his target customer (causes 90% of crop losses). A clear problem statement lead to the simplified value proposition, “Full Crop Protection”. The product needed more locally- rather than regionally-relevant weather data. The positioning needed to be insurance rather than speculative finance.

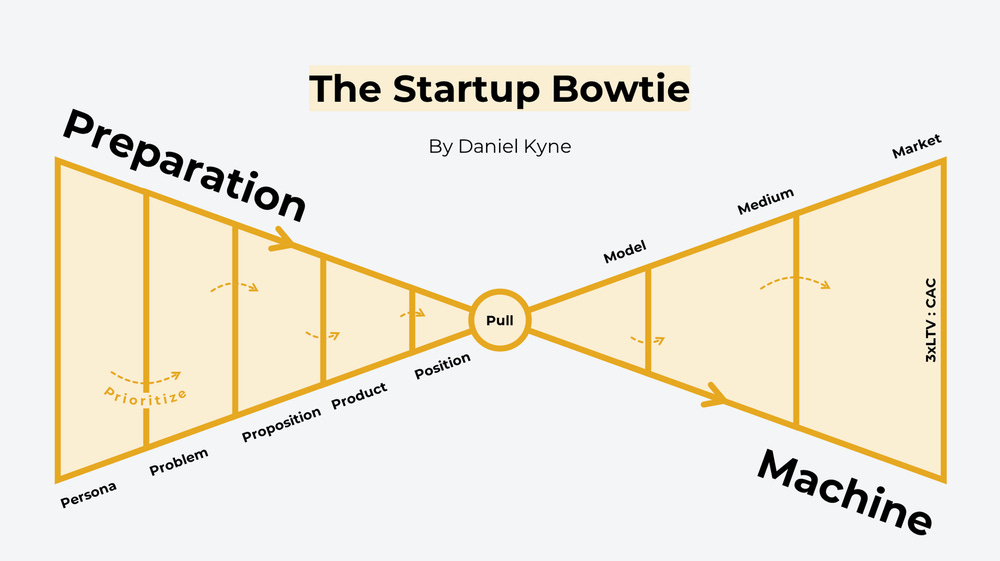

WeatherBill couldn’t articulate which exact problem it solved because it hadn’t picked a target customer. It couldn’t articulate its value proposition because they didn’t know which problem to focus on solving. Each of these discoveries are based on the discovery that came before it. This recognition of dependencies follows the framework we call 'The Startup Bowtie'.

The Startup Bowtie is pretty simple. If the best startups win in their market [Positioning] because they provide the best solution [Product] that solves [Proposition] a high-priority pain point [Problem] for their customers [Persona], then to become one of these successful startups, our decisions should be made in the reverse order of that statement:

Persona → Select a homogenous segment of customers.

Problem → Identify a high-priority pain point where those customers are actively searching for a better solution.

Proposition → Articulate the value that those customers would receive by solving that problem.

Product → Shortlist the 1-3 key features that you would need to build to solve the problem and deliver that value.

Positioning → Choose the right market context for your product so that customers instinctively understand (i) what it is, (ii) how it should work, and (iii) what the competitive alternatives.

The Startup Bowtie helps us to avoid optionality by forcing us to make specific decisions in a way that narrows the set of options available for the next decision — hence its bowtie shape.

In my opinion, the best part of the Startup Bowtie framework is that it also recognizes which decisions come before product/market fit [Preparation Phase] and which are discovered as a result of initial traction [Machine Phase].

The ‘Machine Phase’ consists of Model (revenue model), Medium (how you reach customers), and Market (where do you scale to once you’ve successfully executed the initial strategy). The machine side of the bowtie is hard to figure out without actual traction because you can only learn it by getting to know your customers really well.

Model

David had built the WeatherBill revenue model around the period of time covered, weekdays versus weekends, and the type of weather events insured against. For farmers, they didn’t care about these arbitrary criteria — they just wanted to protect their crops. So David aligned with how farmers perceived the product’s value and sold plans on a ‘per acre covered’ model.

Medium

Farmers were not the right market to build a self-service finance product for in 2007. Once they had committed to the pivot, WeatherBill adopted an outbound direct sales strategy with a very successful +50% close rate.

Market

Within 3 years of committing to the pivot, WeatherBill had become one of the world’s largest providers of data to the agri sector. They used this credibility, existing customer base and data moat to build a suite of data-driven intelligence products for farmers. This is ultimately what made WeatherBill such as attractive acquisition candidate for Monsanto in 2013.

Although WeatherBill included farmers in their overall strategy from 2007 to 2010, it wasn’t until they focused on farmers as their primary customer segment that the discoveries listed above could be made. That’s because the insights that drive decisions on the ‘machine’ side of the bowtie generally can’t be discovered until you’ve first found specific answers for the five ‘preparation’ ingredients.

Summary of Learnings

While this post deconstructed the pivot of a 3-year old startup, my aim was to give you the insights you need to help get things right the first time around. Pivots are painful and worth avoiding (by doing discovery research right in the first place). Here are my four top takeaways from this post:

1. Optionality Tax

The longer you hedge your bets on multiple customer segments, the longer you’ll have a confusing, vague value proposition. I wrote about learning this lesson first-hand at my startup OpinionX in the essay ‘How stack ranking saved us from building the wrong product’.

2. Specificity Sells

As author Rob Fitzpatrick says, “Before we can serve everyone, we have to serve someone.” This applies to every aspect of the Startup Bowtie — repeatability is only possible with specificity.

3. The 5 Preparation Ps

You can’t know that you’re solving a big problem for someone until you know who that someone is; you don’t know what value you offer until you’ve figured out which problem you solve; etc. Building a startup means understanding the dependencies between its ingredients: Persona, Problem, Proposition, Product, and Positioning.

4. Post-’Pull Point’

You won’t know what goes into the scalable playbook until you’ve built something people want in the first place. That’s a big reason why startups take 2-5 years before they hit PMF — this shit takes a long time to figure out! The “scalable playbook” in this case includes revenue model, customer acquisition strategy, and long-term market expansion plan.

If you enjoyed this post, subscribe to our newsletter — we generally email you once every 2-6 weeks, only when we’ve posted a new essay that we think you’ll really like.

When I’m not writing posts about startup strategies, I’m the Co-Founder of OpinionX; a free research tool that helps thousands of product teams to stack ranking people’s priorities. Learn more about OpinionX here or read the rollercoaster story behind my own successful pivot here.

Daniel

Co-Founder of OpinionX — a free research tool for stack ranking people’s priorities.

Note: OpinionX has been used commercially by the team at WeatherBill (now known as Bayer Crop Science). The events described in this essay took place long before OpinionX was founded.